Services

Portfolio Management

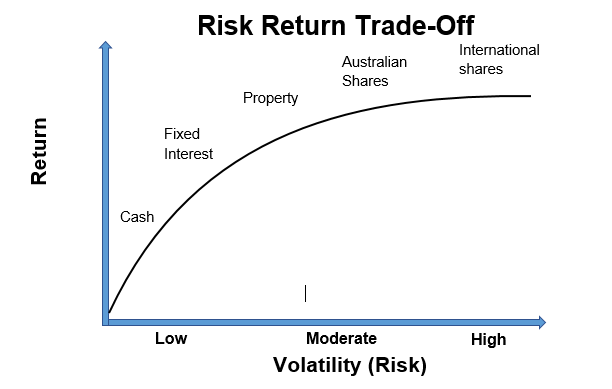

Investing involves risk. Investment risk is the chance that an investment will not give you the returns you had hoped for or that you will lose money. Almost all investments have risk, but some have more than others. The four main types of asset classes are Cash, Fixed interest, Property and Shares.

Generally, investments that are expected to provide higher returns such as Property, Australian Shares & International Shares involve greater risk. While these investments are likely to produce greater returns over longer time periods than more conservative investments, such as Cash and Fixed Interest, losses can occur over shorter periods.

Before making decisions about investments, it is important to understand the risk you are prepared to take to achieve the desired returns and the consequences of that decision on your ability to meet your goals and objectives.

To determine your investor risk profile, we consider many variables, including your personal attitude towards risk, your investment experience, the diversification of your investments and your investment time horizon.

Generally speaking, the higher the risk, the higher the potential return.

Personal Attitude Towards Risk

History shows that investments offering the potential of high returns also carry higher risk, while investments carrying low risk typically only offer the potential of lower returns. Some investors are prepared to accept high levels of risk for the possibility of high returns, while others will accept lower returns as they find comfort knowing they have less risk.

People have different risk profiles which can reflect variations in their financial situation, their age, their goals and objectives, their time frame, previous financial experience, their knowledge, as well as personal values and beliefs. It is important to understand your willingness to take on risk as well as your capacity to handle the risks associated with your investments.

Diversification Of Your Investment Assets

A key strategy to manage risk is diversification.

Diversification is another way of saying “don’t put all your eggs in the one basket”. There are many different areas to allocate your funds; such as

- Cash

- Fixed Interest

- Property and

- Shares

All of which have different risk/return characteristics.

Diversification is about spreading your investments over a range of assets, investment managers and markets both in Australia and Internationally. Diversification will not prevent loss but will help even out returns over your portfolio by reducing overall volatility.

Diversification helps reduce investment risk because the greater the spread of your investments, the less chance there is that all your investments will perform poorly at the same time. Diversification within asset classes is also important to reduce individual investment risk.

Investment Time horizon

The length of time that you plan to invest your money is known as your “investment time horizon”. It is important for determining the type of investments that should be in your portfolio.

The longer the time frame before your funds are required, the more you can allocate to growth assets (ie Shares and Property), which have more volatility but should provide better returns than defensive assets (ie Cash and Fixed Interest) over the longer term.

If, on the other hand, you only have a couple of years over which to invest, you are generally investing for the short term and security may be more important than higher returns. Accordingly, you might place a greater emphasis on investments in short-term, more secure assets, such as cash and fixed interest.

Over time, investment markets move up and down as does the value of your investments. If you have many years over which to invest, you may be prepared to take on more risk. In this situation, with more time to ride out any short-term fluctuations in investment returns, you have the opportunity to benefit from the higher expected returns offered by growth investments such as shares.

Investment Experience

Risk/Return Profile And Asset Allocation

The structure of the different investment assets used to create a portfolio to meet your objectives is referred to as “Asset Allocation”. History shows shares deliver the highest return over the longer term, but also carry the highest level of risk and volatility.

The movement over time in the price of shares is generally more variable than other investments. The long-term movement of property values is less variable, but the trade-off is a generally lower return than shares. Cash and Fixed Interest carry the lowest risk and over the long-term returns are lower.

Choosing where to invest your money can be a difficult decision and will depend on many factors, including your overall investment objectives, risk profile and the amount of time you have to invest.

Most investment specialists believe that asset allocation is vital in generating returns. Although there are many investment products in the market, it is the asset allocation rather than the actual investment products which differentiates high returns from low returns and will enable you to reduce the risks involved with investing.

Generally, asset classes will not all react in the same way. It’s likely that some asset classes will have above average returns in a particular year, while other asset classes may have below average returns for that same year.

Asset classes are often split into two categories: Defensive assets and Growth assets.

Defensive assets provide lower returns with lower volatility. Examples of defensive assets are fixed interest investment options such as debentures, bonds and bank bills and cash investment options which include bank deposits.

Growth assets are investments that offer higher returns over the long-term with higher volatility. Examples of growth assets include property, shares and alternative investments (such as infrastructure).

As mentioned previously, the type of risks you are exposed to will be determined by the type of assets in which you choose to invest. Fixed interest and cash investments will generally be lower risk (defensive assets) and assets such as property and shares are generally considered to be higher risk (growth assets).